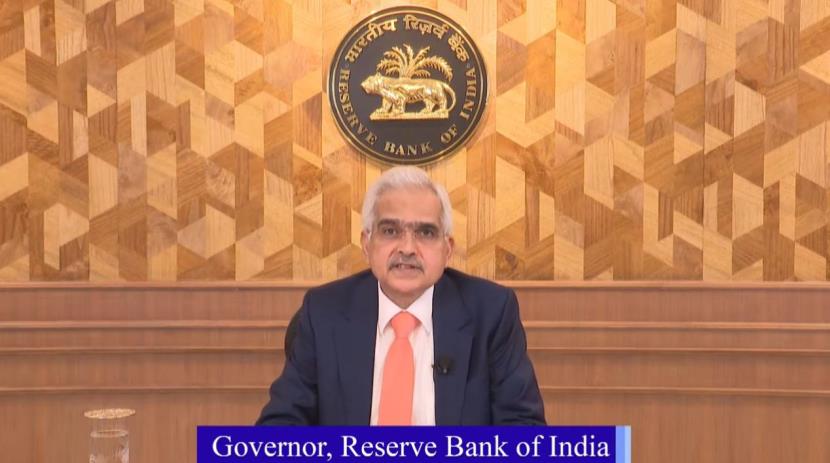

MUMBAI: Reserve Bank of India (RBI) Governor Shaktikanta Das announced during the Monetary Policy Committee (MPC) meeting that the central bank has decided to keep the policy repo rate unchanged at 6.5 per cent for the 10th consecutive time, on Wednesday.

The decision was made with a majority vote of 5 out of 6 MPC members. The standing deposit facility (SDF) rate remains steady at 6.25 per cent, while the marginal standing facility (MSF) rate and the bank rate are both maintained at 6.75 per cent.

Das also highlighted a shift in the RBI’s monetary policy stance, moving to a neutral approach. “The MPC has decided to change the stance of monetary policy to neutral while remaining unambiguously focused on a durable alignment of inflation with the target, alongside supporting growth,” he stated.

This neutral stance reflects the RBI’s balancing act in managing inflationary pressures while ensuring that economic growth is not compromised.

The central bank’s focus remains on achieving a stable inflation rate, aligned with its long-term target, while fostering sustainable economic expansion.

With inflation risks persisting amid global economic uncertainties, the RBI’s approach will allow it the flexibility to respond to both inflationary trends and growth needs without making premature policy shifts.

The meeting, which commenced on October 7, has drawn considerable attention as the RBI has consistently held the repo rate at 6.50 per cent over the past nine meetings, carefully balancing inflation risks with the need to support economic growth.

The Monetary Policy Committee (MPC) is assessing key factors such as persistent inflationary pressures, particularly in food prices, and global economic uncertainties. According to data from the Ministry of Statistics & Programme Implementation, although All India Consumer Price Index (CPI) inflation eased to 3.65 per cent in August within the RBI’s 2-6 per cent target range food inflation remains high at 5.65 per cent, exceeding the central bank’s medium-term target of 4 per cent.

Additionally, rising global crude oil prices, driven by geopolitical tensions in West Asia, have further heightened inflationary concerns.

Despite these challenges, the RBI has maintained its stance on the repo rate, focusing on fostering economic recovery following the pandemic.